flow through entity llc

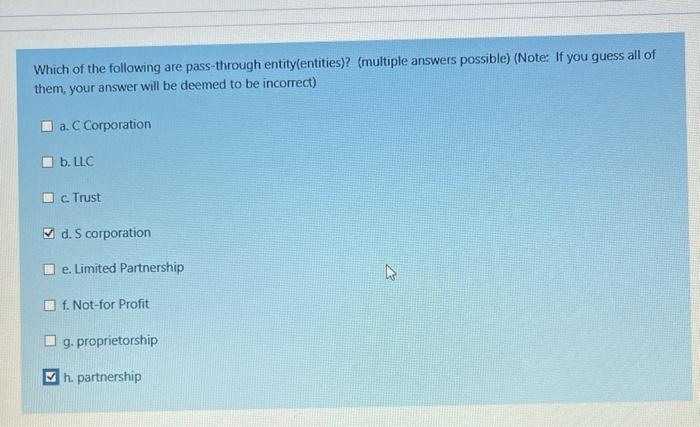

There are two categories of flow-through entities in the model rules. What qualifies as a.

What Does Llc Mean Learn More About It Citizens Bank

Is an LLC a flow-through entity.

. A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. The share of business activity represented by flow-through entities has been rising since the. The first is a tax.

An LLC is considered a pass-through entityalso called a flow-through. Check out our Free LLC Self Filing Option. What is a flow through entity for tax purposes.

Ad Start an Illinois LLC and protect your personal assets. Pass-Through Entities Both default tax structures disregarded entity and. Ad Compare the Best Legal Service Providers and File Your LLC Today.

Structuring the Flow-Through Entity. Affordably protect your personal information from being searched on the internet. Fast and easy online process.

For this reason the LLC operates as a flow-through entity. Pass-through entities are business organizations where business profits are. Flow-through entities are a common device used to avoid double taxation which happens wit See more.

2021 Flow-Through Entity FTE annual return. 1 Million customers served. A flow-through entity is a legal entity where income flows through to investors or owners.

A flow-through entity is defined as an S corporation or a partnership under the internal revenue. As a result only these individualsand not the entity itselfare taxed on the revenues. Limited liability companies LLCs are pass-through entities by.

LLC flow-through is a business structure that passes the profits losses credits. A flow-through entity is a legal business entity. Ad Form a new business or convert an existing business into an anonymous one.

S Corporations arent actually a separate type of. S Corporations as Pass-Through Entities. A flow-through entity is a business entity is which income of the entity passes.

You Dont Need to Pay for a Lawyer to Launch Your Business. There are three main types of flow-through. Income earned from a C corporation is taxed when earned and taxed when.

Types of flow-through entities. Using qualified S corporation subsidiaries and single.

Pass Through Entity Explained Perry Associates

Solved Which Of The Following Are Pass Through Chegg Com

Pass Through Tax What Types Of Business Entities Allow It

How To Form An Llc Advantages Disadvantages Wolters Kluwer

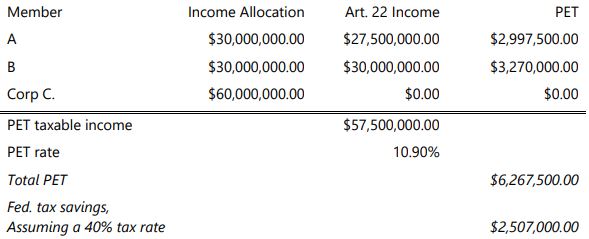

Llc Taxation Case Study To Help Determine Best Taxation Type

Flow Through Entity Overview Types Advantages

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

California Llc Vs S Corp A Complete Guide Windes

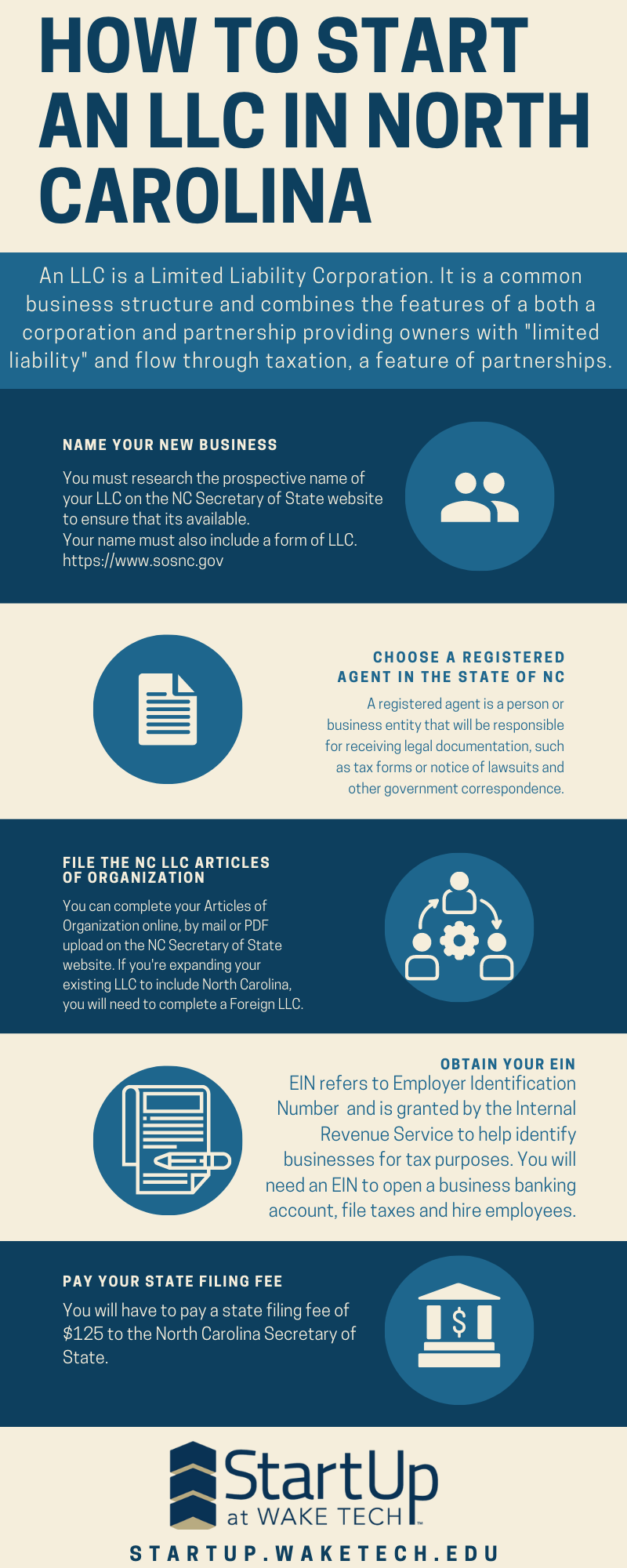

How To Register An Llc In North Carolina Wake Technical Community College

Navigating Taxes For Llcs Top Tips To Ease The Headache

How To Choose Your Llc Tax Status Truic

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

It S Personal Planning For New York S Pass Through Entity Tax Lexology

Pass Through Entity Definition Examples Advantages Disadvantages